Crypto Coins Free Mining An Insightful Exploration

Crypto coins free mining sets the stage for this enthralling narrative, offering readers a glimpse into a world where digital currencies can be acquired without the burden of upfront costs. As the cryptocurrency ecosystem continues to evolve, understanding the nuances of free mining can open doors for new enthusiasts eager to dive into the blockchain space without financial constraints.

This exploration will delve into what crypto coins are, the innovative methods of free mining, and the tools that can help you embark on this journey. From understanding the differences between coins and tokens to examining the risks and future potential, this guide is designed to illuminate the path for aspiring miners.

Understanding Crypto Coins

Crypto coins are digital currencies that utilize cryptography for secure transactions. They play a vital role in the cryptocurrency ecosystem by enabling peer-to-peer transactions without intermediaries. Popular examples include Bitcoin, which was the first cryptocurrency, and Ethereum, known for its smart contract functionality. Other notable coins are Ripple (XRP), designed for fast and low-cost international payments, and Litecoin, which offers faster transaction confirmation times.

While crypto coins are often used interchangeably with tokens, they differ in fundamental ways. Crypto coins typically operate on their own blockchain, while tokens are built on existing blockchains. For instance, Ether (ETH) is a crypto coin on the Ethereum blockchain, whereas tokens like Chainlink (LINK) operate on the Ethereum network but serve different functions.

Introduction to Free Mining

Free mining refers to the practice of mining cryptocurrencies without the need for substantial financial investment. Unlike traditional mining, which requires expensive hardware and significant electricity costs, free mining can be accomplished using basic resources such as a computer or mobile device. Many platforms now offer free mining to attract users, allowing them to earn crypto coins without upfront costs.

The primary benefits of free mining include accessibility and the opportunity to earn cryptocurrency without financial risk. However, drawbacks exist, such as lower mining efficiency and the potential for scams. Users must remain vigilant and conduct thorough research before participating in free mining initiatives.

Methods of Free Mining

There are several methods to mine cryptocurrency for free, each with unique processes and requirements. Understanding these methods is crucial for anyone looking to enter the crypto mining space:

- Cloud Mining: This involves renting computing power from a cloud mining provider. Users pay a fee to access remote servers that handle the mining process, making it easier for beginners without the need for physical hardware.

- Mining Pools: By joining a mining pool, users can collaborate with others to increase their chances of earning rewards. These pools combine the computational power of multiple miners, allowing for more efficient mining and shared profits.

- Faucets: Crypto faucets are websites that give away small amounts of cryptocurrency for completing tasks or simply visiting the site. While the rewards are minimal, they provide an easy entry point into the world of crypto mining.

Tools and Resources for Free Mining

Engaging in free mining often requires specific tools and software to facilitate the process. Here are some essential resources for aspiring miners:

- Mining Software: Various mining software options are available, each with unique features. Popular choices include CGMiner, BFGMiner, and EasyMiner.

- Mining Forums: Online communities such as Bitcointalk and Reddit provide valuable insights, support, and shared experiences from other miners.

- Educational Resources: Websites like Investopedia and Coindesk offer articles and tutorials that help beginners understand mining concepts and strategies.

| Mining Software | Features |

|---|---|

| CGMiner | Open-source, supports multiple platforms, customizable settings |

| BFGMiner | Supports ASIC and FPGA, real-time statistics, remote interface |

| EasyMiner | User-friendly interface, mining pool support, various algorithms |

Risks Involved in Free Mining

While free mining presents opportunities, it is not without risks. Engaging in these activities can expose miners to various dangers, including:

- Security Concerns: Miners risk their personal information and assets if they use untrusted platforms. Ensuring that the mining sites are secure and reputable is essential.

- Scams and Fraud: The free mining space is rife with scams promising unrealistic returns. Common fraudulent schemes include Ponzi schemes and fake mining programs designed to steal funds.

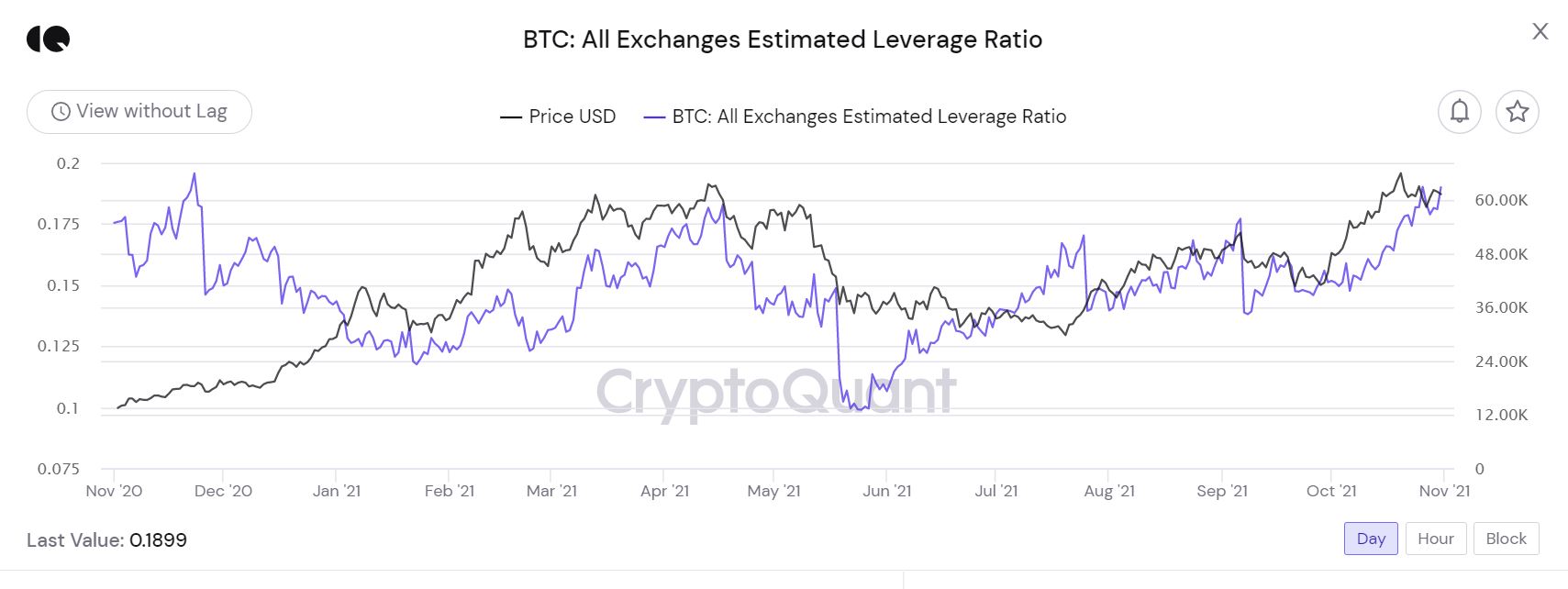

- Market Volatility: The cryptocurrency market is highly volatile, and the value of mined coins can fluctuate dramatically, affecting potential earnings.

Future of Free Mining

The future of free mining is shaped by evolving trends and technological advancements in the cryptocurrency landscape. It is expected that:

- Increased Accessibility: As more users seek to enter the crypto market, platforms offering free mining options will likely expand, making it easier for beginners to participate.

- Technological Innovations: Advancements in mining algorithms and hardware could enhance mining efficiency, potentially changing the dynamics of free mining.

- Sustainability Concerns: With growing awareness of environmental issues, there might be a push towards more eco-friendly mining practices, influencing how free mining is conducted.

Case Studies of Successful Free Miners

Several individuals and groups have successfully mined cryptocurrency at little to no cost by employing effective strategies. For example, a group of college students leveraged cloud mining services to pool their resources. They strategically chose a reputable provider, earning a steady stream of coins while sharing operational costs. Another case involves a tech-savvy individual who utilized free mining faucets, consistently completing tasks to accumulate small amounts of various cryptocurrencies, later converting them to more valuable assets.

These case studies exemplify how dedication and informed decision-making can lead to success in the realm of free mining, serving as inspiration for aspiring miners.

Final Wrap-Up

In summary, crypto coins free mining presents an exciting opportunity for individuals looking to participate in the cryptocurrency revolution without significant investment. By understanding the various methods, tools, and risks involved, aspiring miners can confidently navigate this landscape and potentially reap the rewards of their efforts. As technology advances and the crypto space continues to grow, the future of free mining looks promising.

Common Queries

What is free mining?

Free mining refers to acquiring crypto coins without the need for significant financial investment, often through methods such as cloud mining or participating in mining pools.

Are there any risks associated with free mining?

Yes, risks include potential scams, security vulnerabilities, and the possibility of not earning as expected due to market fluctuations.

How does free mining differ from traditional mining?

Traditional mining often requires expensive hardware and consumes a lot of energy, whereas free mining can utilize shared resources or cloud services with minimal costs.

Can anyone participate in free mining?

Yes, as long as you have access to the necessary tools and resources, anyone can participate in free mining.

What tools do I need for free mining?

You may need specific mining software, access to mining pools, and a secure digital wallet to store your coins.

.01 Captures the Attention of Solana (SOL) and ..." title="New Crypto Priced at

.01 Captures the Attention of Solana (SOL) and ..." title="New Crypto Priced at